“The stock market is filled with individuals who know the price of everything but the value of nothing.” – Philip Fisher

In the early 1800s, the Prussian Royal family urged their citizens to sacrifice their gold and silver jewelry in order to fund the war against Napoleon. In return, they received jewelry made out of cast iron with the inscription Gold gab ich für Eisen – meaning “I gave gold for iron”. Within weeks these iron pieces became incredibly popular, demonstrating that the wearer was not only wealthy, but wealthy enough to sacrifice gold in order to help the war effort. Those who wore gold and silver were looked down upon as unpatriotic and cheap.

In his excellent article Have You Ever Tried to Sell a Diamond?, Edward Jay Epstein recounts that when the first diamond mines were discovered in South Africa in 1870, the financiers instantly discovered a problem – diamonds were actually pretty commonplace. In order to protect their investment they established a cartel to carefully control the supply of these precious stones, known today as De Beers. In order to fuel demand, De Beers spent millions marketing diamonds as a necessary part of courtship and something that should be passed down through families for generations. Diamonds are forever.

In the 17th century, newly introduced tulips became popular throughout northern Europe and saw extreme price inflation. At the peak of tulip mania (as it is now known), a single bulb was selling for around ten times the annual income of a skilled craftsman. Traders stockpiled the bulbs, hoping the prices would continue to rise. Though we don’t know the exact cause, over the course of a few weeks the prices of these bulbs crashed, ruining the fortunes of many speculators.

Whether it be gold, diamonds or tulips, value is derived from what someone else is willing to pay. Over the short term, the same is true for stocks. Stocks fluctuate wildly over the short term because what’s driving the price is perceived value and speculation.

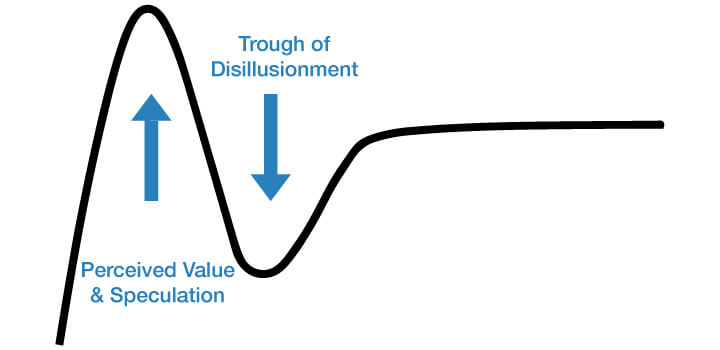

We see this regularly with new technologies because often there is no telling what the long term value of a some untested product is. There’s actually a rough graph that is used to explain this known as the Hype Cycle. New products often gain mass media attention and the perceived value is inflated beyond what’s actually reasonable. It then drops into what is actually referred to as “The Trough of Disillusionment”, before leveling out as the actual value is realised.

We saw this with solar power in the 1980s and e-commerce during the tech bubble. Right now it’s possible that 3D printing is stuck in its own “Trough of Disillusionment”, and perhaps self-driving cars will be the next victims.

Over the long term however, the value of a company tends to follow its earnings. A company like Google (I still can’t get use to calling it Alphabet), for example, is creating incredible value year after year. Everyday it’s paying thousands of employees, helping promote businesses and financing new technologies. Is there much doubt that Google will continue to grow and diversify its business? I would argue it’s almost a certainty and this is what you should be looking for in a great stock.

People get flustered when it comes to investing because they try too hard to put concrete numbers on those things that we can’t foresee with real certainty. What’s more important is to identify great businesses that are creating value for all their shareholders; not just the investors, but their clients, employees, suppliers etc.

The value of these companies isn’t just measured by what someone is willing to pay for them, it can be measured in actual money being created every day through products and services. Often you’ll hear people complain that these stocks are expensive or overvalued, but that’s simply the price you pay for owning great businesses. Great management and visionary leadership comes at a price, but the true value consistently reveals itself over time. Companies that continue to adapt and innovative will always be a good buy.

Rubicoin operates a full disclosure policy. Rubicoin staff currently hold long positions in Alphabet (Google).

Emmet Savage

Emmet Savage