As a species, we’re not especially suited to long-term investing. It doesn’t come naturally to us for a number of reasons and that makes it difficult for us to get started and even harder for us to stick with it throughout our lifetime.

Firstly, investing was not really necessary or possible until less than a century ago. Think about the fact that in 1900, the average life expectancy in the United States was 48 years old. You basically worked until you couldn’t anymore and then relied on the charity of others. Retirement wasn’t a concept until it was first introduced in Germany in 1889.

William Bernstein, a financial author and theorist, explains that throughout our evolution, the fight-or-flight response that kept us away from predators now restricts our ability to think long-term when it comes to investing our money. When we see danger, we take the decision to flee almost immediately. “Those sort of instantaneous, impulsive, emotional responses are basically death itself in the world of finance”, says Bernstein.

That inability to think long-term cripples us when it comes to taking those first steps and it’s made much harder by the fact that there is always reasons not to invest.

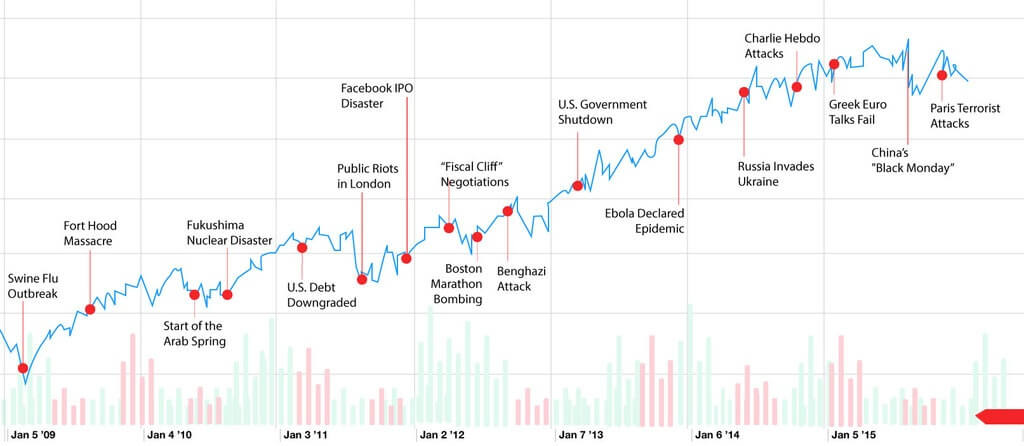

The last seven years have been very good for investors. Since the financial crisis, the S&P 500 has doubled, corporate profits are at record highs, and the few downturns that have occurred have been mild. Plenty of people have made a lot of money during this incredible run, and those who didn’t participate are surely wishing they could turn back time.

However, the people who stayed in the market throughout these years did not have an easy time of it. We had just gone through the worst financial crisis since the Great Depression. In fact many believed we were headed for something much worse. Some of the country’s biggest financial institutions had failed or been taken over by the government. A young president, who had never held executive office, was hurrying through a stimulus plan in order to avert a complete economic catastrophe. Millions of American’s had lost their life savings and now faced the very real possibility of losing their homes.

In the years that followed Europe was thrown into a debt crisis. Italy, Spain, Portugal, Greece and Ireland were all forced to take drastic austerity measures. Unemployment in the U.S. reached levels not seen since the early 1980s and debt skyrocketed. There was a government shutdown, the Boston Marathon was bombed, and a worldwide outbreak of Ebola.

No, these were not easy times to be invested in the stock market. Here’s some of the headlines that we saw over the years.

“Don’t Rule out a Double Dip Recession” – Wall Street Journal, May 2010

“Echoes of The Great Depression” – Wall Street Journal, Dec 2010

“Economy Fears Take Shine of Global Stock Outlook” – Reuters, Jun 2011

“Another Global Recession? Buy India, Sell China”. – Fortune, Sep 2011

“Europe Poses Global Recession Threat: IMF” – Reuters, Jan 2012

“China Slowdown Could Spur Global Recession” – CBS, Mar 2012

“Bill Gross: We’re Witnessing the Death of Equities” – Wall Street Journal, Jul 2012

“Get Ready for a Drop in Stock Prices” – Wall Street Journal, Oct 2013

“Doomsday Poll: 87% risk of stock crash by year-end” – MarketWatch, Jun 2013

“Stock Slide as Worries Persist Over Global Growth” – New York Times, Jan 2014

“Oil Prices Tumble to Five-Year Lows” – Wall Street Journal, Nov 2014

“Asian Shares Fall Amid Global Selloff” – Wall Street Journal, Jan 2015

“IMF Downgrades Global Economic Outlook Again” – Wall Street Journal, Sep 2015

Despite all this, and despite numerous domestic and worldwide crises, the stock market kept ticking up.

Today we’re worried about a slowdown in China and the low price of oil. A few years ago it was the high price of oil that was causing concern. Every day there will be some news headline telling us not to invest and most of us won’t. We procrastinate and put off those things in life we believe to be difficult.

When it came to creating Rubicoin, the goal was to make it as easy as possible for people to get started investing. That’s because I believe that long-term buy and hold investing will benefit those who partake. However, you have to make the choice to get started.

Remember, there’s always reasons not to invest. If you wait for the perfect moment, you’ll be waiting forever.

Emmet Savage

Emmet Savage